Find Drivers License Number Using Ssn

You must provide 1 source document from the list below. DC DMV will NOT accept documents that are not listed below to satisfy proof of Social Security number.

What is a data breach? A data breach is a security violation in which sensitive, protected or confidential data is copied, transmitted, viewed, stolen or used by an unauthorized individual. Some examples of data breaches include: • Hacking (unauthorized intrusion into a computer or a network) • Credit or debit card numbers are stolen online or at a point-of-sale terminal • Documents or devices containing sensitive information are lost, discarded or stolen • Sensitive information is posted publicly on a website, mishandled or sent to the wrong party • For many more examples, see PRC's It's important to understand that a data breach does not necessarily mean that you will become a victim of identity theft.

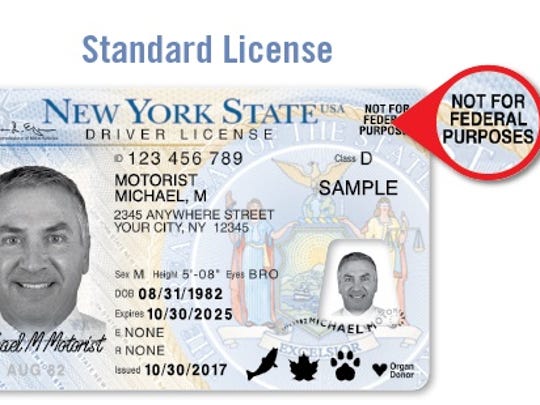

If you are a victim of a data breach, you are at greater risk of identity theft, but until your information is misused, you are not considered an identity theft victim. • An identity theft victim is a person whose personal information not only has been exposed, but also has been misused. • If you have already become a victim of identity theft, please see our Consumer Guide. What should you do if your personal information has been exposed by a data breach? Your first step is to figure out what kind of breach has occurred. This will help you determine the action that you need to take. Four major kinds of data breaches are: • A breach involving your credit or debit card information • A breach involving another existing financial account • A breach involving your driver's license number or another government-issued ID document • A breach involving your Social Security number • A breach exposing your password The sections below describe the action that you should take to protect yourself for each of the above four types of breaches.

Breach involving your credit or debit card information Breaches of your credit or debit card information may occur in retail stores at point-of-sale (POS) terminals or as part of an online transaction. These breaches can be massive in size, sometimes affecting millions of cardholders. You might become aware of a breach affecting your credit or debit card because your financial institution has reissued your payment card with a new account number. However, many financial institutions do not automatically reissue cards that may have been compromised. If you become aware (through news media coverage or otherwise) that there has been a payment card breach at a retailer at which you have shopped, what should you do? First, determine whether you have used a debit or credit card at the merchant.

There is far greater risk to you from a compromised debit card. If your debit card is used fraudulently, funds can quickly be withdrawn from your bank account without your knowledge. Your bank account can be emptied. On the other hand, if you used a credit card, you will have an opportunity to dispute any fraudulent transactions before you have to pay the bill, so you will still retain access to the funds in your bank account. After you determine the type of payment card that you may have used, take these steps to reduce the risk of fraud: • Ask your card issuer to cancel your current card and reissue the card with a new account number. They are not required to do so, and there may be a charge for the replacement card. However, this is especially important if you have used a debit card at the breached entity.

• Carefully monitor all your account transactions. • If your card issuer offers it, set up text or email alerts of any activity. • Make sure that your account statements arrive in your mailbox at their normal time. Consider setting up access to online statements, with email notification from the card issuer when your statement is ready for viewing. • If you become aware of any fraudulent transactions, immediately call your financial institution and follow up by formally disputing the transaction in writing. • Be suspicious of any email or phone call that you might receive about the breach that requests personal information. Breach involving your existing financial accounts If the breach involves an existing financial account, such as a checking, savings, money market, or brokerage account, here are some steps that you can take to reduce the risk of fraudulent activity: • Ask your financial institution to cancel your account and issue a new account number.

Game aqua life 3d cheats manual download. Key search: aqualife 3 d cheats manual. Aqualife 3 d mod apk, aqualife 3 d tips, aqualife 3 d download, aqualife 3 d pc, aqualife 3 d hack, aqua life 3 d apk, aqua life 3 d game, aqualife 3 d hack AquaLife 3 D is your real aquarium in your mobile device! Features: - realistic 3 D fish and decorations. AquaLife 3 D Tips, Tricks, cheats, guides, tutorials, discussions to clear hard levels easily. Amazing fish tank and aquarium game with stunningly realistic 3 D graphics. Grow fish and other aquatic creatures, sell them when the time is right and buy decorations with the money earned.